Due to the development and popularity of the use and integration of cryptocurrencies into everyday life, the number of fraudulent schemes that threaten investors, users and ordinary people who simply want to save or multiply their funds is growing in parallel. If a few years ago such scams seemed exotic, today fraudsters operate en masse, in a widespread manner and are increasingly sophisticated in terms of technology. Promises of easy enrichment, platforms offering to earn on “token investments”, fake sites with imitation of exchanges, pseudo-analysts that actually lead to a fraud network, and even messages on social networks that supposedly come from acquaintances – all these are elements of well-thought-out schemes aimed at one goal: to take possession of your money, crypto assets or personal data.

How to avoid becoming a victim of fraud on the Internet when dealing with cryptocurrency?

First of all, you should remember the main rule: the victim of scammers is not only an inexperienced beginner, but also a completely savvy investor who accidentally stumbled upon a scheme that looked convincing. In order not to fall into the trap when exchanging cryptocurrency, you should follow the basic principles of cyber hygiene. Do not enter recovery phrases, keys or passwords on unknown sites. Check the platform URL before making any transfer or authorization. If you receive a message with a link, do not click on it without a critical assessment. Do not trust dubious projects that promise large payouts for minimal investments or activity on social networks. Real cryptocurrency does not have instant guarantees of profit. If you are told otherwise, you are most likely in front of a scam or ponzi scheme.

Also, critically evaluate sites that offer to get something for free – tokens, coins, participation in the launch of a new project, “gifts” for registration. Most often, this is phishing or the beginning of an attack on your cryptocurrency wallet.

Types of cryptocurrency scams

Dozens of fake platforms, projects, and accounts appear on the Internet every day, preying on both beginners and experienced cryptocurrency users with equal enthusiasm. Let’s consider the most common schemes that are actively operating today.

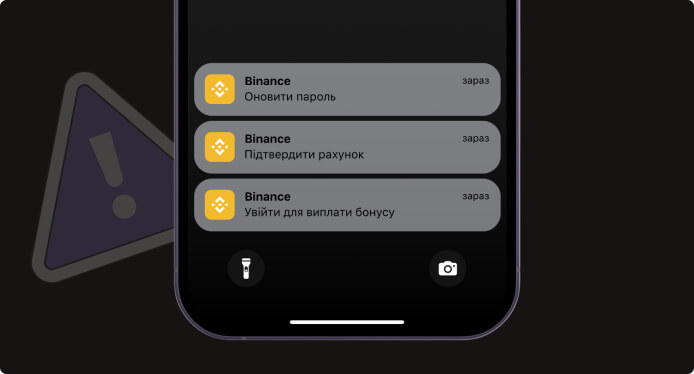

- Phishing. This is one of the oldest, but still extremely effective, fraud schemes on the Internet. Victims are sent a message with a link to a fake site that outwardly copies the interface of a well-known cryptocurrency service, exchange, or wallet. You are asked to “confirm your account,” “update your password,” or simply “log in to claim your bonus.” As soon as you enter your private key, recovery phrase, or other confidential data, the money disappears. Your wallet is hacked, and crypto assets are transferred to unknown addresses, with no possibility of return.

- Pump & Dump. This is a well-known tactic that has been actively used since the days of traditional financial markets, but in the cryptosphere it has gained a new scale. The essence is simple: a group of organizers massively buys up a cheap or little-known coin, creates the illusion of growth – through social networks, forums, artificial trading volume. This stimulates investors to join the “promising” asset. After the rate increases, the organizers instantly drain their assets, provoking a collapse. As a result, those who joined later are left with an empty balance and without any guarantees.

- Investment scams and pseudo-exchanges. You can be lured into a “unique project” where they promise payments, profits from investing in a new exchange, token or mining platform. Often a beautiful website is created, where there are counters, ratings, even fake reviews. You deposit funds, expecting passive income, but after a certain stage – either your account is blocked, or the service simply disappears. Such scams are sometimes disguised as international projects, with localization for different countries, including Ukraine.

- Cryptocurrency pyramids and Ponzi schemes. This is a digital adaptation of the good old pyramids. They tell you about a stable income, attract you with bonuses for new participants, offer to receive part of the payments from other users. At first, everything seems honest – indeed, money comes in. But only as long as there is an influx of new depositors. As soon as the number of interested parties drops, the platform instantly “dies”, along with the wallets and dreams of the victims.

- Fraudsters on social networks. Social networks are a real breeding ground for fake accounts that masquerade as acquaintances, bloggers or even official crypto companies. They may write to you with a “promotional offer”, ask you to help “transfer money” or send a confirmation code, which is actually the key to your account. People often accidentally fall for such messages, especially when they are designed convincingly and the site looks very professional.

What to do to avoid being scammed when exchanging cryptocurrency?

First of all, use only proven exchanges, official exchangers or well-known services with a reliable reputation. Pay attention to the blockchain network to which you send the asset, and do not trust anyone with your keys or wallets. You need to check everything – from the website, to the details, card or account of the recipient. Always verify the information, even if the case looks “familiar” or “simple”.

Never transfer crypto in a private chat, especially in p2p schemes without guarantees. Use services with an escrow function, which provide blocking of the value until the payment is confirmed. Also, do not forget about basic digital hygiene – use strong passwords, two-factor authentication, separate email addresses for registration, do not store passphrases in the cloud or on an open device.

Is there anything you can do if you still become a victim of cryptocurrency scammers?

Although it is often difficult to recover funds after a completed fraud due to the decentralization and anonymity of blockchain networks, it is still worth taking action. First of all, record all the evidence: website screenshots, messages, wallet addresses, transfer details. Report the incident to your bank if a card was used, as well as to international resources such as Chainabuse, Scamwatch, or the exchange’s support service. You can also contact Ukrainian or international law enforcement, cyber police, or lawyers specializing in cryptocurrency cases. In some cases, it is possible to freeze assets by blocking them on centralized exchanges if the transactions have not yet been completed.

The main thing is not to be silent and not to delay. The sooner you start acting, the more chances you have to at least partially return the money or prevent further fraud. To avoid becoming a victim, you should remain cautious, check every step, avoid scam sites, do not respond to aggressive offers, do not follow suspicious links and do not share your passwords, keys, phrases with anyone, even if it seems to you that this is an “official message”.

Trust only official services, follow cyber hygiene, be attentive to the little things, because they are the ones who save you at the moment when scammers are already preparing their next scheme.

Support

Support