With the development of modern technologies and the growing popularity of cashless payments, electronic wallets are becoming increasingly popular among users. These convenient and secure tools allow you to make payments, store, and manage cards all in one place. In this article, we will explore the key aspects of obtaining and using an electronic wallet, as well as delve into questions about crypto wallets.

How to Get One?

The first step in using an electronic wallet is to obtain it. Today, there are numerous wallet options that you can install on your smartphone or computer. Some of the most popular wallets include Google Pay, Apple Wallet, PayPal, Binance, Trust Wallet, WhiteBit, Kuna, and more. Let’s go through several fundamental steps to get an electronic wallet:

Downloading the App

After selecting a wallet, head to the official app store on your smartphone (Google Play/App Store) and download the corresponding wallet application.

Creating an Account

After downloading the app, open it and create an account. You may need certain personal data and information for registration, such as your name, email address, and password. Remember to choose a strong password and keep it in a secure place.

Account Verification

Some wallets might require account verification. This can be done through email or via an SMS message with a verification code.

Adding Payment Methods

Once you’ve created an account, you can add your payment methods to the wallet. These can include credit cards, debit cards, MasterCard or Visa, bank accounts, Monobank or PrivatBank cards, electronic payment systems, and cryptocurrencies.

Done!

Now you can make payments with your electronic wallet instead of a physical card. If your phone supports NFC, you can simply touch your phone to an electronic terminal, and the money will be deducted from your card (just like using a physical card). An Internet connection is not required for this. With Binance Pay, you also have the option to pay using an account number in Binance or via a QR code.

How to Withdraw Money?

If you have funds on your bank card, you can withdraw money from an ATM that supports NFC technology. In this case, simply touch the reader with your phone or smartwatch and follow the instructions. A physical card is not required as a digital version of the card is used.

With cryptocurrencies, things get even more interesting. You can withdraw cryptocurrency to a Monobank card or a PrivatBank card through an exchange, for example, one like Binance. You can also check the rates on Obmify, choose the best option considering the commission, and perform an exchange through one of the online cryptocurrency exchangers in Ukraine. Additionally, Ombify allows cash withdrawals. Moreover, you can convert to the currency of the exchange point’s cashier, whether it’s in hryvnia or another currency.

How to Top Up?

There are various methods to top up your electronic wallet, depending on the type you use. If you’re using an electronic wallet linked to a bank card, you’ll need to know your card number. Typically, in an electronic wallet, there’s an “Add Funds” option where you can choose your payment method. Afterward, you will be directed to a secure payment system device where you will need to input your card number, expiration date, and CVV code. You can also top up your account through self-service terminals, for instance, from PrivatBank or iBox. In some of them, top-ups can be done without a physical card.

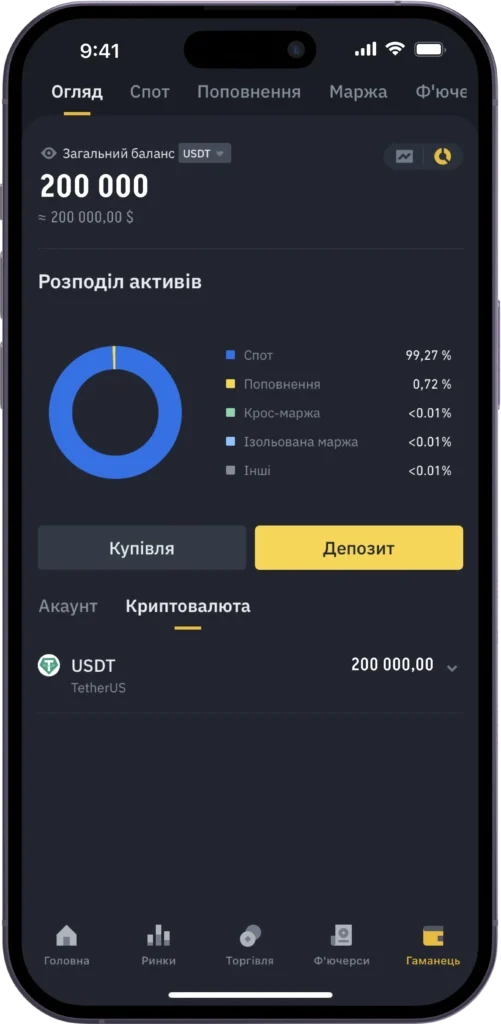

For a cryptocurrency wallet, you’ll need to enter the personal account of the exchange, for instance, Binance, where you can select the “Top Up Wallet” or “Deposit” option. There, you’ll see the address for the top-up transaction. Then, you’ll need to purchase cryptocurrency on the exchange, specifying the amount and choosing the payment method.

You can also purchase cryptocurrency for your balance on Obmify using a bank card or even cash.

Advantages and Disadvantages

Electronic and cryptocurrency wallets have their pros and cons. Let’s start with the pros:

Offline Access: No internet access is needed for use. This is especially convenient in situations where there’s no connection or you’re in a location with limited network access.

Security and Convenience: Physical money can be replaced, reducing the risk of loss or theft of cash. Moreover, the convenience of fingerprint or phone payments allows for quick and effortless transactions.

Global Access: Electronic and cryptocurrency wallets can be used in any country, making them universal and convenient for international transactions. You can receive payments from any part of the world without border restrictions.

Subscription and Prepayment Convenience: Some virtual wallets allow setting up prepayments for specific services or products. This ensures the automatic receipt of payments without the need for manual data input each time.

Transaction Tracking and Financial Management: Electronic apps allow for easy and efficient tracking and control of your finances. They provide convenient access to transaction history with receipts, budget creation, and expenditure analysis.

As for disadvantages, they mainly concern usage specificity, as this novelty might be challenging for some users. Also, special attention should be paid to security – creating and storing passwords, and so on.

Support

Support