Crypto appeared about 10 years ago, but interest in it has increased in the last few years. One of the reasons is that people are gradually realizing the value of the asset to multiply their capital. If earlier many were wary of cryptocurrency, now curiosity prevails. If we consider the market itself, it is relatively young.

However, this is not a disadvantage, because it is growing and developing very actively. This trend has been followed from the very beginning to the present time. Periodically, new promising projects appear in the field of cryptocurrency, and existing ones are updated. However, in order to evaluate all these perspectives and get the desired results, one must first acquire the basic knowledge. Our detailed guide will help with this.

What is cryptocurrency trading?

The definition of the concept follows from the name itself. That is, these are trades on a specialized market. The object can be both cryptocurrency and contracts (futures). In the first case, there is a successful acquisition or sale of an asset at a certain point in time.

This type of trading is called spot trading. This is the simplest and most understandable option. It will be an excellent solution for those who do not want to understand a large number of nuances. The essence of the method consists in two simple steps:

- Buy a coin when its price is at low marks.

- Sell cryptocurrency when its price increases significantly (by 5, 10, 100 or more times).

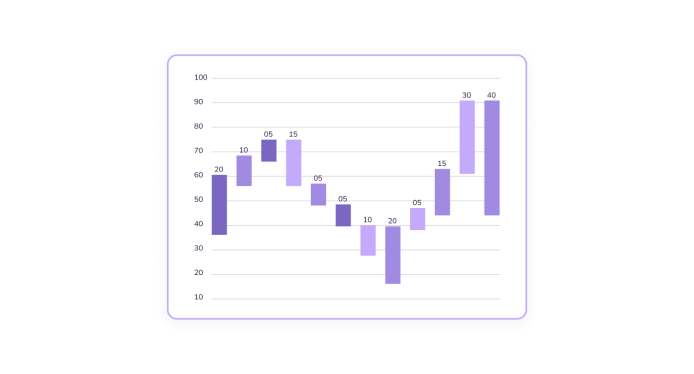

Before using the method, be sure to perform analysis on the graph. It helps to understand in which price zones it is worth buying positions, and in which to sell. If you want to successfully close the deal, you need to take into account the cyclicality of the cryptocurrency market and the main patterns.

Trading (margin or futures) should be highlighted separately. It provides for the conclusion of exchange agreements on the rise or fall of the price. Such requests are also called warrants. They are hosted on an exchange that provides all the necessary tools for digital currency transactions. The essence of such trades is to open short (short) or long (long) positions.

The first (Short) predicts a fall in price, and the second – its rise. If the deal is successful, the trader makes a profit. Importantly, both types of trading open opportunities to multiply your funds, but each of them is also associated with risks. After all, by choosing an unfavorable entry point, you will lose a certain percentage of the allocated deposit.

Basic concepts and specifics of trading

To better understand the specifics of the type of activity, start by studying the basic concepts. For example, from the definition of the platform on which cryptocurrency trading takes place. It is called “exchange”. This is a specialized site that is created for transactions with coins and tokens. To access all functions and create an account, a trader must create an account.

Also understand what fiat is and what its role is in the market. It is quite simple to do this, because this concept is called ordinary currency, in particular, dollars, euros, etc. The main purpose of these assets in the case of trading is conversion to crypto. With a certain amount, you can exchange for popular coins BTC, ETH and many other types. In the future, they can be stored in a special wallet. It should be chosen taking into account the criterion of safety.

Another important concept is liquidity. In the context of stock exchange trading, it means the speed at which cryptocurrency can be exchanged for fiat. That is, the higher the liquidity, the better. The list of basic concepts includes volatility. It describes how drastic changes in the price of a crypto can be over a certain period of time. Low numbers mean minimal price fluctuations.

If we consider the specifics of trading, it is worth noting two types of exchanges: CEX and DEX. The first category includes centralized platforms in which their work is controlled by a certain group of people (management). In the second case, there is no such regulation, since these are decentralized sites that are controlled by the participants themselves.

How to choose a crypto for trading?

There are hundreds and even thousands of different coins on the market right now, with varying volatility and price ranges. It is not easy for a beginner to navigate in such a variety of cryptocurrencies. However, the task can be made easier. This requires careful analysis of several factors. Here are some of the most important of them:

- Trading volume per day. This is a strong indicator that reflects the demand for cryptocurrency among traders. If the indicator is high enough, it means that the electronic asset is popular and shows active market movement;

- Total capitalization. The indicator is another important factor that helps to understand the scope of the project and the operations that are carried out with it;

- The time during which the project works is also important. During the launch phase of the coins, there may be sharp fluctuations in the price, and after some time they weaken.

What factors can affect the exchange rate of cryptocurrency?

The current price of a coin is an important aspect for any trader. That is why you need to know how it is formed. The main factors in this case are the ratio of 2 factors: supply and demand. It is formed on the basis of several indicators:

- Interest in the asset. If more and more traders and investors show interest in a certain cryptocurrency, the rate automatically increases. The same rule applies in the opposite direction.

- Legalization of the coin at the state level. This is another powerful factor in the increase in value.

- Consider the mining process. For example, in BTC, it is limited, which ensures a sure increase in value.

Cryptocurrency trading steps for beginners

After understanding the features of trading, proceed directly to studying the procedure of trading on the stock exchange. Next, familiarize yourself with the following aspects.

Understanding the market

The first important factor for any trader is analytics. To make money from trading, you need to be able to analyze the market situation. Various methods are used for this. For example, fundamental analysis. This approach involves monitoring news and events that occur in the cryptocurrency sphere.

It is about project updates, partnerships, investor sentiment, prevailing trends (bullish or bearish trend), etc. It is also necessary to carry out technical analysis on the chart to understand in which price ranges there are support and resistance levels, whether candlestick patterns and other figures have formed .

Method of trading

Experienced traders highlight several trading options. They are based on time intervals. For example, some choose day trading and close trades within 1 or maximum 2 days. Some professionals use the scalping technique. This option is suitable for those who want to get the result even faster.

Trading strategy

It is formed individually for each beginner, because it depends on the character, approach to trading on the stock exchange, skills and many other features. However, in most cases, several aspects can be taken as a basis. In particular, the time allocated for operations, the deposit, the number of factors for opening a deal, as well as the methods of analysis. Having decided on these points, you can build your successful strategy for trading limit or market orders.

Risk management

When choosing trading, all beginners want to avoid losses. However, risks still exist, as the situation is constantly changing, and not always in the predicted direction. That is why professionals advise to follow the rules of risk management. They provide for diversification, competent calculation of transaction interest on the stock exchange, as well as a deposit limit for one transaction in trading.

Summarizing all of the above, several conclusions can be drawn. Cryptocurrency trading is impossible without understanding the basics of market institutions and the formation of the market value of assets. In addition, it is important to be able to analyze the trends and the current state in order to understand in which direction the price will move. Well, a mandatory aspect is to familiarize yourself with the features of a specific cryptocurrency and the work of the exchange.

Support

Support