In today’s digital world, online payments have become an integral part of our everyday life. The rapid growth in the popularity of online commerce, telecommuting and international transactions increases the demand for reliable payment services. Ukrainian users, unfortunately, do not always have access to the popular PayPal service, especially when it comes to receiving funds or using the full range of functions. This forces users to look for alternative platforms for receiving, storing and transferring funds.

Payment system – what is it?

The payment system is a set of tools and services that allow individuals and legal entities to conduct financial transactions. They act as intermediaries for processing payments, transferring funds and making other transactions. A payment system includes various components: cards (credit or debit cards), online wallets, mobile applications for transfers, as well as currency conversion and transaction processing mechanisms.

Key characteristics of the modern payment system:

- Security and verification. The modern payment system provides a high level of user data protection using multi-level verification, encryption and other security mechanisms.

- Internationality and multi-currency. Most payment systems allow transactions with different currencies (dollar, euro, pound, cryptocurrencies, etc.).

- Convenience for business and private users. Users of payment systems can not only send and receive money, but also manage business accounts, make bulk payments and receive payment details.

- Minimization of currency conversion costs. Many payment systems offer favorable conditions for converting funds, which is important for international transfers.

- A wide network of partner banks and payment systems. It is important that the selected payment system maintains contact with the main banks and has partnership relations that ensure the quick receipt of funds.

Are there alternatives to PayPal payment systems in Ukraine?

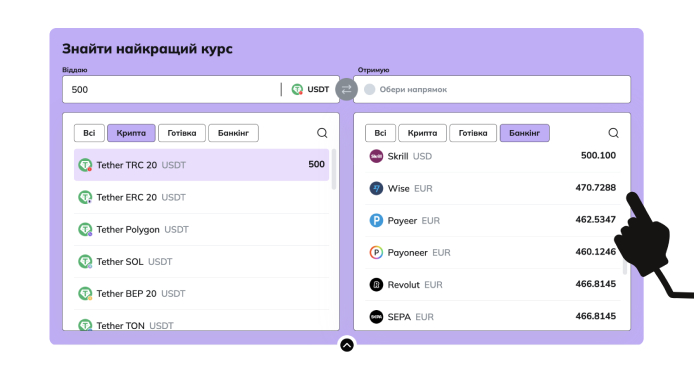

Yes, today in Ukraine you can use several payment services that replace PayPal and have different functionalities. The most popular among them are Wise, Payoneer, PaySera, Revolut and Zelle. Each payment system has unique features that distinguish them in terms of service, fees, functionality and level of user support. These platforms are suitable for both personal and business needs, helping users receive and withdraw funds with minimal conversion losses or fees.

Comparative characteristics of payment systems Wise, Payoneer, PaySera, Revolut and Zelle

Wise

Wise is a British fintech company, formerly known as the payment service TransferWise, which has been actively developing technologies for fast and profitable international transfers since 2011. Wise’s goal is to provide users with access to profitable currency exchange and easy international transfers, minimizing the high commissions and hidden fees inherent in traditional banking. The payment service also offers users a debit card, which can be used to make purchases and withdraw funds from ATMs, converting money at minimal rates. Wise account clients can make both personal and business transfers.

Advantages:

- International transactions at a favorable rate. The payment system works on the basis of a system of local bank accounts in different countries. For example, when a user in Ukraine wants to send funds to the United States, Wise withdraws the amount from the Ukrainian account and transfers it to the American account, which allows you to avoid high international bank fees.

- Transparency of commissions. The Wise payment service charges a fixed fee, which is usually much lower than that of bank transfers or traditional services, and always indicates it before the transaction.

- Multicurrency account. The Wise payment service offers a multi-currency account, where you can store funds in more than 50 different currencies, which allows you to avoid constant conversion. This is especially beneficial for those who often work with different currencies.

Disadvantages:

- Restrictions in limits for new users;

- The payment service does not support all countries for sending funds;

- Lack of support for cryptocurrencies such as ethereum or litecoin.

Payoneer

Payoneer is an American financial company that provides services for international transactions, receiving funds and business management. Founded in 2005, it has established itself as a reliable payment system for those who work with foreign customers, especially freelancers, entrepreneurs and small business owners. Security is also important to Payoneer — it uses multiple levels of verification to protect customers’ accounts and personal data. The high popularity of the Payoneer payment service is due to its availability for users in many countries of the world, as well as the convenience of receiving money directly from international clients or partners.

Advantages:

- Multi currency account. Users receive invoices in various currencies, including USD, EUR, GBP, JPY, which allows you to receive funds from international clients and avoid complicated conversion.

- Withdrawal of funds. The payment service allows you to withdraw funds to a local bank account in Ukraine or withdraw cash through ATMs with a favorable commission.

- Mastercard from Payoneer. The payment system offers users a physical and virtual Mastercard debit card, which allows you to withdraw funds and pay both online and offline.

- Integration with freelance sites. Payoneer integrates with popular freelance platforms like Upwork, Fiverr, and Airbnb, making it a convenient tool to get paid for your work.

Disadvantages:

- High commissions for withdrawing funds from the card at ATMs;

- Paid issuance of the card;

- Quite high tariffs for currency conversion.

PaySera

PaySera is a Lithuanian payment system created to serve private and business customers. It provides favorable conditions for making international payments, storing funds in several currencies and providing a European account with IBAN. PaySera is especially popular among Ukrainian users due to the ease of registration and convenient interface. An additional advantage of PaySera is a simple and clear registration and verification process.

Advantages:

- International transfers in euros (SEPA). For transfers in the euro currency through the SEPA service, the commissions at the PaySera payment service are lower than at banks, which is beneficial for those who often make transactions with European partners.

- European IBAN account. The payment system allows you to get a personal IBAN account on the card, which allows you to easily receive and send funds throughout Europe.

- Convenient maintenance of business accounts. For businesses, the PaySera payment platform offers bulk payment tools, a virtual POS for online stores, and features to manage multiple accounts and cards.

- Account security and protection. PaySera uses two-factor authentication and data encryption to protect accounts from unauthorized access.

Disadvantages:

- Lack of support for USD and other currencies for storing funds;

- Amount limits and the need for additional account verification.

Revolut

Revolut is a UK-based fintech service that provides mobile banking, international transfers, currency exchange and stock and cryptocurrency investments. Revolut was founded in 2015, and in a short time it has become very popular thanks to its low fees and extensive financial management capabilities through the mobile application. The Revolut payment system allows users to open and manage a multi-currency account through a mobile app, allowing them to easily monitor all their transactions. The disadvantage of Revolut for Ukrainians is that the platform does not have official support in Ukraine, and also introduces transaction limits, after which additional commissions are removed.

Advantages:

- Mobile banking. The Revolut payment system allows users to open and manage a multi-currency account through a mobile app, allowing them to easily monitor all their transactions.

- Free transfers between Revolut users, which is convenient for payments with friends or family without fees.

- Investments. The platform allows you to invest in stocks and cryptocurrency, which is a unique feature for services of this type. Users can buy and sell cryptocurrencies, including ethereum and litecoin, through the app.

- Revolut payment card. The platform offers debit cards that can be used for cash withdrawals and purchases both online and in offline stores around the world.

Disadvantages:

- Lack of official support for Ukraine, which limits functionality;

- Limits on free transactions, after which commissions apply.

Zelle

Zelle is an American mobile money transfer payment system designed for fast domestic transactions between bank accounts. Zelle was founded in 2017 and became popular with instant transfers between users to cards served by various US banks.

Advantages:

- Speed of transactions. Card and bill transfers are sent instantly, making Zelle convenient for paying between individuals in the US.

- There are no fees for transfers within the US, which is good for small card payments between friends or family.

- Integration with banking applications. Zelle is supported by most major US banks, allowing users to transfer to a card or account.

Disadvantages:

- Only suitable for individuals without the ability to create business accounts;

- Requires a US bank account.

Which payment system is better to choose? выбрать?

The choice of payment system depends on your needs. If you plan to receive and send funds in euros to the card, PaySera is a good choice with low fees. Wise is suitable for those who regularly make international transfers, as it offers favorable conversion conditions. Payoneer is great for freelancers and businesses, while Revolut is ideal for those looking for extensive financial management features.

Each of these platforms allows you to conduct international transactions, store funds in multi-currency accounts, perform profitable currency conversion and use a digital or physical wallet for withdrawals. It is important to understand your financial needs and take into account the conditions, limits and possible commissions of the chosen platform.

Support

Support