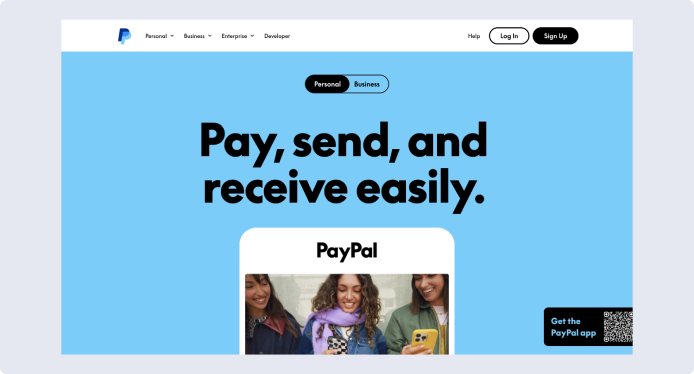

PayPal is one of the most popular payment systems in the world, providing users with convenient and secure ways to pay and receive money online. The system was founded in 1998 and became the first major electronic platform to offer international transaction services. It allows payments in various currencies, making it a universal tool for individuals, businesses and large corporations.

The main feature of PayPal is its multicurrency and the ability to work with various bank accounts and cards. It supports currency conversion using the mid-market rate with the addition of a small percentage of commission, which allows users to send and receive money around the world with minimal exchange losses. Authentication and verification of accounts provide a high level of protection, and modern encryption algorithms make PayPal one of the most reliable services for financial transactions.

How does the PayPal payment system work?

PayPal acts as an intermediary between your bank account, card and e-wallet, providing safe and fast transactions. The system minimizes the need to transfer your financial data to sellers or other users, which makes it one of the most reliable payment platforms. Let’s consider the PayPal work process in more detail:

Creating an account. The user begins by registering an account on the official website or through a mobile application. At this stage, it is necessary to:

- Select the account type – individual or corporate. The first is suitable for personal needs, the second – for business.

- Enter personal data, such as name, residential address, email address, phone number and others.

- Link one or more bank cards (debit or credit) or a bank account. This will be required to send and receive funds.

- Go through the verification process, which includes confirming your email and card. The card is verified by writing off a small amount, which is then returned to the balance after confirmation.

Sending and receiving payments. One of PayPal’s key features is the convenience of sending money. To transfer funds, the user only needs to know the recipient’s email address or phone number linked to his account. The algorithm is as follows:

- The sender enters the recipient’s details and the transfer amount.

- PayPal notifies the recipient of the receipt of funds via email or an application.

- Funds immediately appear on the recipient’s balance. They can be used for payment or withdrawn to a linked bank account.

In addition, the recipient can submit a payment request, which is sent to the sender through the built-in functions of the service.

Currency conversion. If the sender’s currency differs from the recipient’s currency, PayPal automatically makes an exchange:

- The system uses the current rate with a small commission percentage added.

- The user sees the final amount in their currency before confirming the transaction. This feature is especially convenient for international payments, as it allows you to transfer money without having to convert it in advance at the bank.

Purchase protection. One of the unique features of PayPal is the purchase protection program, which is relevant for purchases in online stores:

- If the product was not delivered, was damaged or does not match the description, the buyer can submit a request for a refund.

- The system considers complaints and conducts an investigation, providing a decision in favor of the buyer or seller.

This makes PayPal a profitable tool for users who want to minimize risks when shopping online.

How to use PayPal payment system?

Registration. The registration process is simple and includes several steps:

- Visit the official PayPal website.

- Select the account type: individual or corporate.

- Enter your personal information, including email address, residential address and bank card details.

- Confirm registration via email.

Tariffs and fees. PayPal offers current rates depending on the type of transaction:

- Personal transfers between countries may include a percentage of the conversion fee.

- Paying for goods through online stores is often free for the buyer, and the seller is charged a fixed commission.

- Withdrawing money to a bank account or card is accompanied by minimal fees.

Main functions:

- Balance replenishment.

- Sending and receiving funds.

- Payment in online stores.

- Setting up a payment system for business.

There are jurisdictions and restrictions on the use of PayPal in some countries, as well as transfer limits for new users before passing full verification.

Opening a PayPal account: how does it work?

Opening a PayPal account involves several steps:

- Selecting an account type.

- Entering personal data and creating a password.

- Linking a bank card or payment account.

- Going through the authentication process: confirmation via SMS, email or other methods.

- Verification of data to remove restrictions and increase transaction limits.

The main advantages and disadvantages of PayPal

Advantages:

- Convenience and simplicity. The PayPal payment system interface is intuitive, making payments to accounts is quite simple.

- Internationality. Ability to work with more than 25 currencies.

- Purchase protection. High level of payment security for users.

- Multi-currency wallet. Easy currency conversion.

- Global availability. PayPal payments work in most countries of the world.

Disadvantages:

- Commissions. For business and when converting currencies, commissions may be higher than those of competitors.

- Restrictions for some countries.

- Possible freezing of funds for suspicious transactions.

Can PayPal be used in Ukraine?

Yes, PayPal is available in Ukraine, but with some restrictions. Ukrainian users can:

- Send payments and pay for goods.

- Receive funds to their PayPal balance.

- Withdraw funds in hryvnia or other currencies linked to their account.

PayPal has established itself as a universal and reliable payment system that provides users with convenient tools for financial transactions and payments online. Simple registration, the ability to work with bank accounts, cards and an e-wallet, as well as support for more than 25 currencies make PayPal indispensable for both private users and businesses. International coverage allows you to quickly and safely make transactions around the world, and the built-in currency conversion function simplifies settlements (payments) between countries. The system guarantees a high level of data protection and offers purchase protection programs, minimizing risks when paying for goods and services. Thanks to its functionality, PayPal has become an important tool for e-commerce, personal transfers and financial flow management, remaining one of the most popular platforms on the global market.

Support

Support