Paysera is an international payment system that provides a wide range of financial services for individuals, entrepreneurs and companies. It is an alternative to traditional banking institutions, offering fast, convenient and secure ways to carry out financial transactions online.

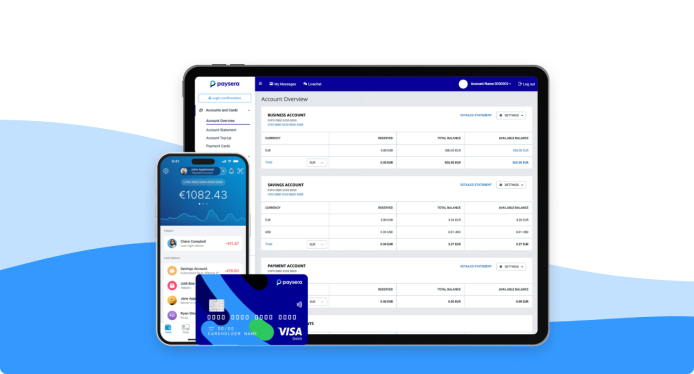

The company was founded in 2004 in Lithuania and has since expanded its operations to many countries around the world. It has received a license from a European financial institution, which allows it to operate in accordance with strict regulatory norms and standards of the European Union. The main advantage of the system is the ability to open an electronic account in different currencies without having to visit a bank. Users can quickly register and get access to online payments, money transfers, currency exchange, fund management via a mobile application and even issue their own Paysera card.

The service is aimed at both private clients and businesses, offering the opportunity to make international payments, integrate payment gateways for e-commerce, convert funds at a favorable exchange rate and use modern technologies for financial settlements.

What financial services does Paysera provide?

Paysera is not just a payment system, but a comprehensive solution for financial transactions. It includes the following key services:

- Account opening and maintenance. Each user can open a personal or business account for free, undergo verification and gain access to all the system’s features. Opening an account takes minimal time, and the identification process can be completed online using digital documents.

- Money transfers. The payment system allows you to make instant transfers between Paysera accounts, which are absolutely free. In addition, money transfers to bank accounts in over 180 countries around the world are available, as well as cash transactions through partner services.

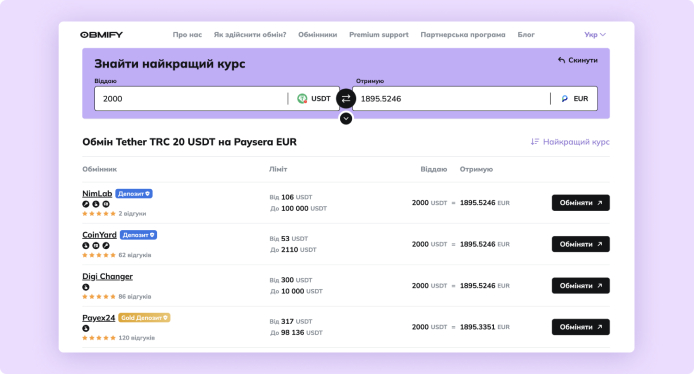

- Currency exchange and conversion of funds. Paysera offers favorable conditions for currency exchange, providing clients with the opportunity to convert funds at the current exchange rate without hidden fees. Currency exchange is available in the mobile application and web version of the platform.

- Issuance and maintenance of a Paysera VISA card. Users can order a physical or virtual card that supports payments in stores, online and contactless payments. The card is linked to an electronic account, allowing you to easily manage your finances through the application.

- Payment for goods and services. The system supports payments in retail stores, restaurants, service centers, as well as the ability to make online payments through online stores and mobile applications.

- Financial services for business. For entrepreneurs and companies, Paysera offers integration of payment systems, the ability to automatically calculate commissions, issue invoices and receive funds through electronic payment gateways.

- Financial control and reporting. Each user has access to detailed analytics on their financial operations, expenses and income in the mobile application. This allows you to easily manage funds, set budget limits and receive notifications about financial transactions in real time.

Features of the Paysera financial payment system

Paysera offers users a wide range of financial opportunities, which makes it a convenient alternative to traditional banks. The main features of the platform include:

- High confidentiality and secure transaction process. Financial transactions in Paysera are protected by modern encryption methods, which ensures maximum user privacy. Access to the account is carried out through two-step authorization, and an additional level of identification is used to confirm transactions.

- Support for multi-currency accounts with the ability to quickly convert funds. Users can open a multi-currency account that allows you to store and operate funds in different currencies. Paysera supports over 30 currencies, and the instant conversion function allows you to easily exchange funds at a favorable rate without additional fees.

- 24/7 access to financial transactions via the mobile application and web platform. Paysera users can manage their funds from anywhere in the world thanks to a convenient mobile application and web interface. All transactions are available online, including money transfers, bill payments, currency conversion, viewing payment history and real-time financial management.

- No hidden fees and low commissions for international transactions. One of the main advantages of Paysera is the transparency of service terms. Users know in advance what commission they pay for transactions, and many services are provided free of charge. For example, internal transfers between Paysera accounts are carried out without commission, and international transactions have a much lower cost than in traditional banks.

- Automated identification and verification for safe use of the system. To ensure the safety of funds, Paysera uses modern methods of customer identification. The procedure takes place in several stages:

- Account registration.

- Uploading digital documents to confirm identity.

- Passing verification through video identification or electronic services.

This system allows you to protect user accounts, prevent fraud and meet international financial monitoring requirements.

Paysera features available to Ukrainian users:

- Ukrainian users can open an account with Paysera and use it in different currencies, including euros, US dollars and British pounds. This is convenient for those who receive international payments, work with foreign companies or often make purchases abroad.

- Thanks to the integrated exchange service, Ukrainians can convert funds into the desired currency at one of the most favorable rates on the market. The exchange is instant, without hidden fees and additional payments.

- Paysera allows Ukrainian users to send and receive money transfers to bank accounts in more than 180 countries. This is especially convenient for those who work abroad or do business with European partners. International transactions are faster and cheaper than in traditional banks.

- Users can issue a physical or virtual Paysera VISA card, which supports payments in stores, online, as well as contactless payments via Google Pay or Apple Pay. The card is tied to the main account, which allows you to easily manage expenses via a mobile application.

- Ukrainian entrepreneurs can connect Paysera as a payment system for their business. This allows you to accept payments in online stores, automate settlements with customers and partners, reduce the cost of financial transactions and optimize cash flows.

- For Ukrainian users, Paysera provides the opportunity for quick registration and identification through electronic documents. This significantly speeds up the account opening procedure and allows you to use all the benefits of the system without the need to physically visit the office or submit paper documents.

What are the types of Paysera money transfers?

Paysera offers different types of money transfers that allow clients to conveniently and profitably send funds in various formats. International transfers are made to bank accounts in over 180 countries, which makes it easy to transfer money abroad. For domestic transactions, users can use instant transfers between Paysera accounts, which are commission-free and in real time. The system also supports cash transfers through partner networks, which allows clients to receive funds in a convenient way. In addition to traditional currency transactions, Paysera offers cryptocurrency exchange and transfer, which is an important option for those working with digital assets.

Paysera payment limits and tariff plans

Paysera offers several tariff plans for its clients that meet different financial needs. The standard account provides basic functions without a monthly fee, which makes it accessible to a wide range of users. For entrepreneurs and companies, a business account is available, which includes advanced features, including tools for managing finances, invoicing, and accepting payments. Transaction limits depend on the level of account verification and the user’s country of registration. The higher the level of identity verification and document confirmation, the larger amounts can be transferred without additional restrictions.

Advantages over other payment systems

One of the main advantages of Paysera is favorable currency exchange rates, which allow customers to convert funds with minimal costs. There are no hidden fees in the system, and all tariffs are transparent. The registration procedure is simple and secure, which allows you to quickly start using the service without unnecessary difficulties. As a result, Paysera is a practical and profitable option for those who seek to obtain a reliable payment system for work in Europe and beyond.

Support

Support