Revolut is a payment system that offers users a wide range of financial services in a convenient and digital format. Founded in 2015, Revolut has become one of the most popular financial services thanks to its innovative approach to money management. The service works with both private and business clients, providing access to a variety of financial transactions, including transfers, currency exchange, cash withdrawals, and even cryptocurrency management.

What is Revolut?

Revolut is a mobile financial service that allows users to manage funds through an app. Revolut is based on a digital wallet that can be connected to a Mastercard or Visa card. Clients can open accounts in various currencies, send and receive payments, exchange currencies at favorable rates, and much more.

Revolut’s key features include:

- Instant payments between Revolut users without fees.

- Currency exchange at the interbank rate to a card.

- Manage cryptocurrencies such as Bitcoin and Ethereum.

- Support for international transfers and payments.

- Ability to order a card for online and offline payments.

Features of the Revolut payment system

The Revolut payment system combines innovative technologies, high transparency, and accessibility, which makes it a universal tool for managing personal and business finances. Let’s consider the key features of this service in more detail:

Currency exchange. Revolut provides users with the opportunity to exchange more than 30 currencies at the real interbank rate. This means that the rate you see in the application corresponds to the current market value, without hidden markups, as is often the case in traditional banks. This system is especially beneficial for those who travel often, pay for purchases in foreign online stores or work with clients abroad. In addition, the application provides automatic notifications about the rate, which help choose the most suitable moment for exchange and payment. However, it is worth considering that the free plan has a monthly limit on free conversions (up to 1000 EUR), after which a commission of 0.5% is charged.

Payment cards. Revolut offers Mastercard and Visa cards that you can order and connect to your account. The cards are issued in two formats: physical and virtual. Physical cards are convenient for everyday spending, and virtual payment cards are suitable for secure online payments, as they are created instantly and can be deleted after use.

Additional card features include:

- Instant blocking. If you lose your card, you can block it in a couple of clicks through the application.

- Setting payment card spending limits, which is useful for budget control.

- Support for various types of payments and payments, including Apple Pay and Google Pay.

- The ability to personalize the card by choosing its appearance.

International payments. Revolut allows users to make transfers to more than 150 countries with minimal or no fees. This is possible thanks to the use of modern technologies that eliminate intermediaries.

Advantages of Revolut international payment transfers:

- Support for payments to both individual accounts and business accounts (cards).

- No fees for SEPA transfers within the EU.

- Low or no fees for payments outside the EU, which is beneficial for freelancers and companies working with international clients.

Working with cryptocurrencies. Revolut provides access to major cryptocurrencies, including Bitcoin, Ethereum, and others. Right in the app, users can:

- Buy cryptocurrency with fiat money, such as EUR or USD.

- Sell and convert cryptocurrency back to fiat assets.

- Store digital assets in your wallet.

This feature is especially useful for beginners, as the interface is extremely intuitive, and the transaction itself is completed in just a few clicks. However, it is worth considering that cryptocurrency transactions may include fees, especially on the basic plan.

Financial management. The Revolut payment system provides powerful tools for managing personal finances. Users can:

- Monitor their expenses in real time thanks to convenient graphs and statistics.

- Create savings accounts (cards) or piggy banks, where funds are collected automatically based on specified conditions (for example, rounding up expenses).

- Receive notifications about each transaction for maximum control.

For users who want to wisely allocate their budget, there are functions that allow you to set spending categories, such as food, transportation or entertainment. This helps you analyze what you spend most of your money on and adjust your habits.

Payment system subscription plans

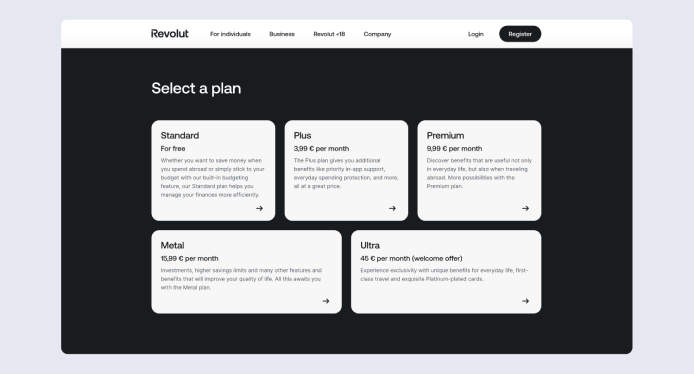

Revolut offers several subscription tiers to meet the needs of different types of customers:

- Free. Basic features, such as currency exchange with a limit of 1000 EUR per month and free SEPA payments.

- Plus. Advanced features are added, including the ability to receive compensation for cancelled events and purchase insurance.

- Premium. Increased limits on cash withdrawals (up to 400 EUR per month), access to exclusive cards and priority customer support.

- Metal. The flagship plan, which includes up to 1% cash back on purchases, increased limits on free currency exchange, travel insurance and access to exclusive offers.

Each plan provides unique payment benefits, allowing users to choose exactly what suits their needs. For example, active travelers will appreciate insurance, while freelancers or entrepreneurs will appreciate higher limits and minimal fees.

How long do transfers from the Revolut payment system take?

Payments and transfers within the system are usually instant, which makes this service convenient for money transactions between clients on cards. For international transfers, the execution time depends on the country and the type of the recipient account. For example:

- Funds are received within one business day to accounts in European banks (SEPA).

- International payments outside Europe can take up to 3 business days.

What is Revolut’s specialty?

Revolut’s specialty is convenience and flexibility. You can:

- Use one payment account to store more than 30 currencies.

- Exchange currencies at the interbank rate without additional markups.

- Receive support and access to advanced tools, including analytical reports and cryptocurrency management.

- Enjoy integration with other digital services, such as PayPal, to simplify payments.

What is the disadvantage of the Revolut payment system?

Despite the obvious advantages, there are also some disadvantages of the payment system:

- Limitations on free currency exchange (the limit on the Free plan is 1000 EUR per month).

- Possible delays in transaction processing in rare cases.

- Not all features are available in every country, which limits use in certain regions.

- Fee for cash withdrawals over the established limit.

- Dependence on the Internet and mobile application, which can be inconvenient if there is no access.

Can Revolut be used in Ukraine?

At the moment, Revolut does not officially provide a full range of its services in Ukraine. However:

- Ukrainian users can create an account in countries where the service is supported and use it if they have access to foreign bank accounts.

- Sending funds from Revolut to Ukraine is possible through international payments to local bank accounts.

However, it is worth considering that registration with Ukrainian documents may be limited. Revolut is actively expanding its presence, so changes are possible in the future.

What is the competitive advantage of Revolut over other financial services?

Revolut outperforms competitors due to:

- Low fees for currency exchange and international payments.

- An intuitive mobile app that offers maximum control over personal finances.

- Possibility to manage both cryptocurrencies and traditional assets in one wallet.

- Using a card and account is convenient for both personal and business transactions.

- All fees and limits are clearly stated, excluding hidden charges.

Revolut combines the functionality of traditional banking services and the flexibility of modern digital services, providing users with unique financial advantages.

Revolut is much more than just a payment service. It is your personal financial assistant, capable of making money management convenient, transparent and modern. Whether you are an individual looking for favorable exchange rates and easy international payments, or a businessman striving for effective control of company finances, Revolut offers solutions that meet the requirements of modern life. It is a service that combines technology, convenience and global opportunities, helping you feel confident in every financial step.

Support

Support