Binance is one of the most popular cryptocurrency exchanges in the world, offering users a wide range of options for trading, storing, and withdrawing cryptocurrency. However, many users in Ukraine are interested in how to withdraw money to their bank card from Binance. In 2025, this remains a pressing issue, and we will consider the top 3 ways to do this safely and with minimal costs.

Is it possible to withdraw money from Binance to a Ukrainian card?

Withdrawing funds to a Ukrainian card from Binance is possible, but it is important to consider several key nuances. Binance provides its users with several methods for withdrawing fiat funds, including hryvnia (UAH), which simplifies the process for Ukrainian residents. The main withdrawal methods include using the Binance P2P service, as well as external payment systems that work with fiat currencies.

The most common method is the Binance P2P platform, where users can directly exchange funds with each other. On the platform, users place orders to sell cryptocurrency, and other users can buy them by transferring money directly to the seller’s bank card. This method is popular due to the ability to avoid additional fees and high transaction processing speed. However, when using P2P, it is important to choose counterparties with a high rating to minimize risks. Also, to successfully conduct such transactions, you will need to link a Visa or MasterCard card to your Binance account. It is important that the card belongs to the account user, since the exchange does not support withdrawals to third-party cards due to security reasons.

Binance also offers additional methods, such as integration with payment systems (both in the form of partner exchangers and through a direct transfer system), which allows you to withdraw funds with minimal fees. However, this option may be less profitable compared to P2P, since payment systems may charge additional fees. It is also worth considering that the availability of various methods may vary depending on the country, so before withdrawing, it is better to check the current conditions and availability of the method for the region.

Do I need verification on Binance to withdraw funds?

In order to safely and stably withdraw funds from Binance, account verification is a mandatory procedure. Verification is a confirmation of the user’s identity that requires uploading documents (passport, ID, or driver’s license) and a photo of the user. The main purpose of this check is to enhance the platform’s security and prevent fraud and other abuses.

During the verification stage, users are also required to provide two-factor authentication (2FA), which is usually done via SMS or an authentication app, which allows for an additional layer of account security. Verified users can not only withdraw funds, but also enjoy a wider range of financial transactions, including access to P2P features, buying and selling cryptocurrency through fiat gateways, and converting assets into various fiat currencies.

Verification not only reduces the likelihood of funds being frozen upon withdrawal, but also speeds up the processing of transactions. For users from Ukraine, this step is especially important, as data inconsistencies or the use of unverified bank cards can lead to delays and complications with withdrawals. Binance thoroughly checks information to prevent accounts from being used for fraudulent purposes. Ultimately, verification not only protects the users themselves, but also helps to enhance the reputation of the Binance exchange as a reliable and secure platform for trading and storing crypto assets.

TOP 3 ways to withdraw funds from the Binance exchange to a bank card

In 2025, there are several reliable ways to withdraw funds from the Binance exchange to a bank card. Let’s consider the three best methods, including Obmify monitoring, Groshx.com exchanger and Trustee Plus platform.

Obmify monitoring

Obmify is a monitoring service that tracks the rating of various exchangers and allows users to choose the direction with the best conditions for withdrawing funds. Using Obmify, you can find exchange services with minimal commission and the most convenient conditions for transferring to a card.

Pros of withdrawing from the Binance exchange:

- Reliability and security. The service cooperates only with trusted exchangers, which reduces the risk of losing funds.

- Low commissions. Obmify examines the commissions in different exchangers and chooses the most profitable option.

- Support for various currencies and withdrawal methods.

- Security deposit. In the event of any unforeseen situations related to your transaction, you can receive compensation.

Disadvantages of withdrawal:

- The need to go to third-party exchanger sites, which can add additional steps to the withdrawal process.

- Sometimes there are limits on withdrawal of funds, which can be inconvenient when withdrawing large or small amounts.

Groshx.com exchanger

Groshx.com is a popular online exchanger that provides convenient conditions for exchanging USDT and other cryptocurrencies for fiat money with the ability to transfer to a bank card. On Groshx.com, you can select the desired currency and make an exchange without unnecessary delays.

Pros of withdrawal from the Binance exchange:

- Simple interface, which allows you to quickly and easily make an exchange, even for beginners.

- You can register with the exchanger, go through verification for conditional card directions, for example, hryvnia – Tether.

- No hidden fees. The service shows all fees in advance, which allows users to know the exact final amount.

Disadvantages of withdrawal:

- In some cases, additional verification is possible, especially for large amounts.

- Dependence on the cryptocurrency rate at the time of exchange, which can be risky in case of high volatility.

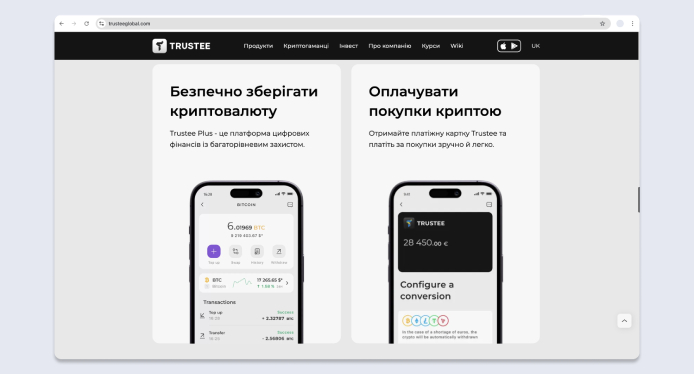

Trustee Plus Withdrawal Platform

Trustee Plus is an e-wallet that is integrated with Binance and allows you to withdraw funds directly to bank cards. Wallet users can use the application to convert cryptocurrency into fiat and withdraw it to the card.

Pros of withdrawing from the Binance exchange to the wallet:

- Instant transfers to the wallet without waiting for transaction confirmation.

- The Trustee Plus wallet supports two-factor authentication and requires confirmation of each transaction, which protects the user’s funds.

- The wallet has a user-friendly interface with support for various currencies.

Cons of withdrawal:

- High commission compared to P2P withdrawal on the Binance exchange.

- The wallet does not support all bank cards for withdrawal; it is important to check the compatibility of the card before use.

Conclusion: tips and methods for safe withdrawal from the Binance exchange

To safely withdraw funds from the Binance exchange to a bank card in 2025, it is recommended to follow the following tips and methods:

- Always verify on Binance to avoid account blocking and freezing of funds.

- Use two-factor authentication and carefully check all details before sending a transaction.

- Closely monitor the exchange rate and choose the best withdrawal methods, such as monitoring and exchangers with a good reputation.

- Make sure that the selected method supports your card (Visa, MasterCard) and country of residence, as some systems limit the ability to withdraw for certain regions.

Following these recommendations, you can minimize risks and successfully withdraw money from Binance to a card at any time.

Support

Support