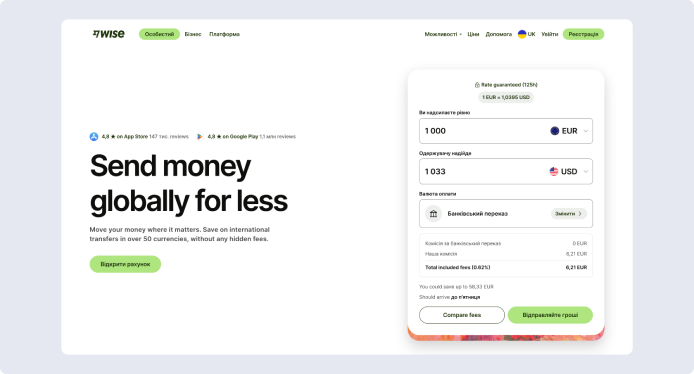

Wise is an innovative system for international money transfers that allows you to carry out operations with minimal costs and at a real exchange rate. Founded in 2011, the company, formerly known as TransferWise, quickly became popular thanks to its transparency, low fees and ease of use. The main goal of Wise is to make financial transactions between countries accessible and fair. Unlike traditional banks, which often charge hidden fees and apply inflated rates, Wise offers to send money with the maximum benefit for the client.

Wise uses an innovative system of local accounts that allows you to avoid transactions through international banking networks. For example, if you want to send funds from Ukraine to Great Britain, the Wise system receives your money in a local account in Ukraine, and then sends the equivalent amount from its local account in Great Britain to the recipient. This approach reduces the cost of money transfer and speeds up the process.

What is needed to start working with the Wise payment system?

To start using the Wise payment system, you need to perform a few simple actions that will provide convenient access to the platform’s functionality and open up opportunities for safe international money transfers. For example:

- Account registration. The first step is to create a profile on the official Wise website or through the mobile application. This process is as convenient as possible: enter your email, come up with a password and confirm your account by clicking on the link that will be sent to the email address you specified. Registration takes only a few minutes and is available even to those who do not have much experience working with financial platforms.

- Identity verification. To ensure a high level of security and compliance with international financial regulations, you will need to confirm your identity. As a rule, this includes uploading a photo of your passport, driver’s license or other form of identification. Depending on the country of residence or volume of operations, additional verification may be required, for example, sending a document confirming the address of residence or passing two-factor authentication.

- Adding bank details. After successful verification, you can start setting up methods of sending and receiving money. To do this, you will need to enter your bank details. Wise supports the connection of both bank accounts and debit or credit cards, which makes the system flexible for different categories of users. The specified data during transfer will be protected by modern means of encryption, guaranteeing the confidentiality of the information.

- Setting currencies. The platform offers users the opportunity to work with several currencies, which is especially convenient for those who regularly send transfers or receive money in different countries. At the setup stage, select the main currency with which you will work (make a transfer), or set up a multi-currency account to store funds in different currencies, such as euros (EUR), US dollars (USD), pounds sterling (GBP) and others.

- Replenishment of the card account. After all preliminary settings, you can top up your balance in Wise. This can be done in several ways: by bank transfer, payment by card or through third-party payment systems. The process of replenishing the card account is fast and intuitive, and the funds become available for money transfers almost instantly.

By following these steps, you can quickly start using Wise, enjoying transparent tariffs, a convenient interface and favorable conditions for international money transfers.

How does Wise work?

Wise offers an intuitive interface for making money transfers. The main stages of work include:

- Sending money:

- Choose the country you want to send money to and enter the amount.

- The system will automatically show the current exchange rate and commission amount.

- Enter the recipient’s data: name, bank account or card details.

- Confirm the operation and wait for the notification about its completion.

- Commissions. Wise is known for its low fees, which are usually much lower than banks or other systems. The size of the commission depends on the amount of the money transfer and the selected currency.

- Exchange rate. Wise uses a real exchange rate, without additional markups. This allows users to save on transactions and get the best result.

How does Wise track a money transfer?

Wise offers convenient tools for tracking the status of a money transfer. After completing the operation, the current status will be displayed in your profile: “processing”, “sent” or “delivered”. The system also provides a tracking code that can be used to obtain additional information about the transaction.

Advantages and disadvantages of the Wise money transfer system

Advantages:

- Low commissions. It is significantly lower than that of banks.

- Real exchange rate. No hidden surcharges.

- Multi-currency functionality. Ability to work with different currencies.

- High level of security. Two-step login, data protection and encryption.

- Fast speed of money transfers. Most operations are completed within a few hours.

Disadvantages:

- Restrictions on the support of some countries and currencies.

- Requirement of mandatory verification, which can take time.

- Impossibility of working with cryptocurrency.

Is it possible to use the Wise payment system in Ukraine?

The Wise payment system is available for users in Ukraine. The system allows you to send and receive money abroad, as well as use multi-currency functions. However, for full access to the possibilities of Wise in Ukraine, it is necessary to go through the identification procedure and comply with all the requirements of the platform. Wise supports money transfers in hryvnia and other popular currencies, including EUR and USD. This makes it the optimal way to make international money transfers to an account or card.

Wise is an innovative platform for international money transfers that combines ease of use, transparency and economic benefit. Thanks to minimal commissions and the absence of hidden costs, users get the opportunity to send money abroad quickly and safely, while knowing exactly how much money will reach the recipient’s account or card. The company’s technological solutions ensure high reliability, and currency exchange is carried out at the real interbank rate, which favorably distinguishes Wise from traditional banking systems. Constant development and orientation to the needs of clients allow Wise to maintain leadership positions in the field of financial services, making international money transfers accessible and understandable to millions of people around the world.

Support

Support