The world of digital finance is constantly evolving, and people increasingly value speed, convenience, and security when making financial transactions. In the context of globalization and the active development of online commerce, instant transfers are becoming not just a desirable option, but a necessity. Traditional bank payments often take several days, can have high fees, and require additional steps to confirm the identity of the sender and recipient. That is why modern payment solutions are emerging that allow people to make financial transactions quickly, without additional costs, and without the need for complex financial instruments.

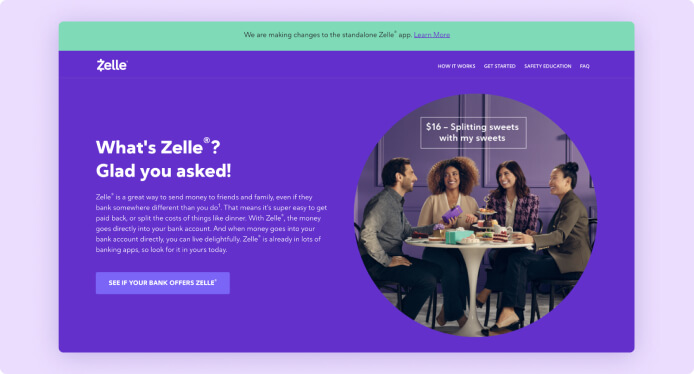

One such effective tool is Zelle, a digital payment system that has gained immense popularity in the United States. It is integrated with the largest banks, making it available to millions of users. The main advantage of Zelle is the ability to instantly transfer funds between bank accounts using only a phone number or email address. This means that there is no need to enter long bank details or create an additional virtual wallet – everything works directly through your bank account.

Zelle: how to make a payment?

The process of sending money through Zelle is as simple and convenient as possible. To do this, you need to:

- Activate Zelle in the banking application. Most major US banks have already integrated Zelle into their online services, so users only need to log in to their bank account and find the Zelle option.

- Add a recipient. To do this, enter the phone number or email of the person to whom the payment is intended.

- Specify the payment amount. You need to specify the exact figure and confirm the transaction.

- Confirm the payment. To complete the operation, authentication using a password or multi-factor authentication is often used.

- The funds are credited instantly – this is one of the main advantages of Zelle.

How to receive funds in Zelle?

Receiving money through Zelle is a simple and convenient process that does not require complex financial instruments or additional confirmations. However, in order for the funds to arrive without delays and problems, you need to follow a few important steps:

- Make sure that your bank supports Zelle. Before using the service, you need to check if your bank is a partner of this payment. Most major US banks have already integrated this payment system into their applications. If your bank does not support Zelle, you can use the Zelle mobile application and link your debit account to it.

- Open a banking application or virtual wallet. To receive a payment, go to your bank’s mobile application or open the Zelle application. There you need to find the function related to receiving funds, which is usually located in the digital payments or wallets section.

- Go through the registration process by linking your bank account. If you are using Zelle for the first time, you need to go through the registration procedure. To do this:

- Indicate the mobile phone number or email address that you plan to use to receive payments.

- Link your bank account (it must be authorized to receive funds through Zelle).

- Confirm your identity by completing a check through the bank’s authentication system.

One of the main advantages of Zelle is the speed of transactions. Once the sender makes a payment, the funds are usually credited to your bank account within seconds. There is no need to manually confirm receipt or enter additional details – the funds will automatically appear in your balance. In some cases, if this is your first time receiving funds through Zelle, your bank may require confirmation that you really want to accept payments through this system. To do this, you need to:

- Log in to your banking app and confirm activation.

- Make sure that your phone number or email is correctly associated with your bank account.

- Take additional security measures, such as entering a password or one-time code.

How to protect your funds when using Zelle?

Despite the high level of security, digital payments always carry certain risks. Since Zelle does not provide a mechanism for refunding funds in the event of fraud or erroneous payment, it is important to follow certain rules of protection.

- Use multi-factor authentication. Multi-factor authentication (MFA) adds an extra layer of security to your account. This can be a password confirmation via SMS, authentication in a mobile app, or using biometric data (Face ID, fingerprint). Enabling this feature makes it much more difficult for fraudsters to access your account without a password.

- Never share your passwords or reveal personal information. Your password, phone number, and email are the keys to your Zelle account. Do not share this information, especially your password, with third parties, even if they are posing as representatives of your bank or Zelle. Official support services never ask for passwords or PINs.

- Verify the recipient’s information before transferring funds. When sending money, always double-check the recipient’s phone number or email address. One mistake in a character can lead to your payment being received by someone else and not being able to be returned.

- Be careful with unfamiliar accounts. There are many scammers online who offer “good” exchange rates or sell products at a very low price, demanding payment through Zelle. Remember: Zelle does not provide a chargeback, so if you come across a scammer, your bank will not help you get your money back.

What should you do if you receive a payment from a stranger on Zelle?

If you receive a payment from an unknown sender, you should follow these rules:

- Do not spend these funds until you find out their origin.

- Contact your bank to get an official confirmation of the transaction.

- If it is a fraudulent transaction, report it to your bank’s security department.

- If you are offered a refund through an alternative method (for example, through another app), it may be a scam.

Is there a fee on the Zelle digital payment network?

One of the main advantages of the Zelle system is the absence of fees for payments between personal accounts within the United States. This means that users can transfer funds without any additional costs, which makes Zelle an attractive option for making financial transactions. However, it is important to remember that Zelle itself as a payment system does not charge fees, but individual banks may set their own restrictions and limits on payment amounts. This may include a limit on the maximum amount of a single transfer or a limit on the total amount of transactions in a certain period (for example, per day or week). In addition, some banks may set limits on the number of transactions that can be made through Zelle, which is worth considering when choosing this payment system.

Advantages of Zelle over other payment systems:

- Speed. Zelle offers instant payments in real time, which is one of its main advantages. Since the funds are transferred without delays, you can expect the received amount to be available in your account immediately after the transaction is made. This significantly distinguishes the payment from other payment systems, where you usually have to wait several days for transactions to complete, especially international ones.

- Free domestic transactions. Zelle does not charge fees for payments between personal accounts within the United States. This allows users to avoid additional costs for financial transactions, which makes this system beneficial for those who frequently make transfers within the country. The absence of fees is a significant advantage compared to other payment platforms, which may charge fixed fees for each operation.

- High level of protection. Zelle uses multi-factor authentication to ensure a high level of security when making transactions. This means that in order to access the platform, the user must go through several stages of verification, which makes it much more difficult for unauthorized access without a password.

- Integration with leading banks. Zelle is tightly integrated with many major US banks, allowing users to make payments directly through their mobile apps or online banking. This makes the process of using the payment system extremely convenient, since you do not need to download separate apps or register with new payment services.

- No need to use a debit or credit card for transfers. Since transactions are made directly through bank accounts, users can make payments without having to add cards or enter other payment card details, which further simplifies the process and reduces the likelihood of errors.

Zelle is a convenient and secure payment system that allows users to instantly receive and transfer funds within the United States. With no domestic transaction fees, a high level of security, and integration with major banks, Zelle is an effective financial tool for those who frequently make transfers. However, despite all its advantages, users should be careful to avoid possible fraudulent schemes, as the system does not guarantee complete protection against all types of fraud.

Support

Support