When it comes to cryptocurrency, usually the first association for the average person is volatility. And experts call the existence of stablecoins the first argument against crypto volatility. What is this currency and what is the point? Today we analyze this issue in more detail. Obmifay – helps users find the most profitable rates for selling or buying stablecoins or other crypto coins, ensuring transparency and security.

What is a stablecoin in simple words?

Stablecoins are a type of cryptocurrency whose value is tied to fiat value by being securely backed by US dollars (USD), euros, gold or other fiat currencies. Unlike Bitcoin and other cryptocurrencies, which can fluctuate greatly in price, stablecoins are designed to provide stability, making them attractive to crypto-assets looking for safer and more predictable digital assets in the cryptocurrency world.

Why are stablecoins needed?

Stable assets play an important role in the cryptocurrency network, as they allow you to quickly and with minimal fees to carry out finances, ensuring a balance between stability and efficiency. Namely:

- Cost savings. By being tied to stable assets such as the US dollar (USDT, USDC cryptocurrencies), stable cryptocurrencies have the ability to insure users against the volatility risk of traditional cryptocurrencies.

- Fast and cheap transactions. Usdt stablecoins allow quick and low-fee financial transfers without the involvement of banks, making them a convenient tool for international transactions.

- Preventing volatility. During sharp fluctuations in the market, users can convert their electronic cryptocurrency assets to stable, to ensure the stability of the value.

- Convenience of trade. Stable cryptocurrency is used by traders to conveniently trade other cryptocurrencies to ensure there is no need to constantly exchange for fiat currencies.

- Decentralized Finance (DeFi). Stable assets are a key element of many DeFi platforms, allowing users to borrow, make bets and collateral to invest directly on the blockchain.

Types of stablecoins

There are two main types:

Centralized stablecoins

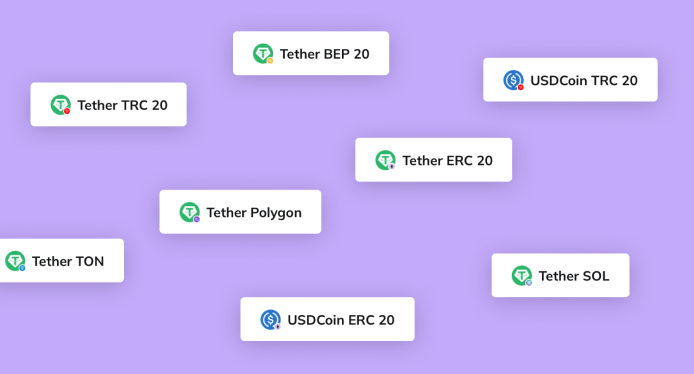

These are those that use real fiat security, that is, have a real reserve in the form of fiat currencies stored in banks or other financial institutions. An example of such stable cryptocurrencies is USDT (Tether) or USDC, which are backed by US dollars. Centralized stablecoins usdt have a simple structure and their value remains stable thanks to transparent security mechanisms during market fluctuations.

Decentralized stablecoins

Decentralized stable cryptocurrencies like DAI are powered by smart contracts and use cryptocurrency collateral. They are not subject to banking institutions, and stability is maintained through algorithms that automatically adjust supply and demand. Such assets are more independent, but without collateral and technical nuances are more difficult to use.

The use of decentralized stable assets allows you to maintain market stabilization through the automatic management of supply and demand with the help of smart contracts.ії ринку через автоматичне управління попитом та пропозицією за допомогою смарт-контрактів.

What are the pros and cons of stablecoins?

Like any financial system, stable has its advantages and disadvantages.

Pros:

- Stability. Pegging to the value of fiat currencies or other assets ensures the stability of the value of stablecoins.

- Fast transactions. Transactions with stable cryptocurrencies are fast, and each payment goes through almost instantly.

- Accessibility. USDT-type stable assets can be accessible to a wide range of users, regardless of their place of residence or financial system.

- Security. Centralized stablecoins are backed by real assets, which gives users additional confidence in the stability of their funds.

Cons:

- Dependence on fiat currencies. Centralized stable assets are controlled by banking institutions, which can create risk in the event of regulatory or inflation issues.

- The risk of centralization. In the case of centralized stable currencies, control can be concentrated in one hand, which does not correspond to the ideas of decentralization.

- Technical difficulties. Decentralized stable assets can be difficult for beginners to use due to the need to understand blockchain technology and smart contracts.

Stablecoin vs Altcoin: The Difference

Stablecoins are cryptocurrencies whose value is stable due to being tied to fiat assets or algorithms that support their stability. They are not intended to significantly increase value, but instead provide a convenient means of asset preservation.

Altcoins are all other cryptocurrencies that are not Bitcoin. They are often used for investment and speculation, and their value can vary widely. Therefore, they are riskier, but at the same time potentially more profitable currencies for investors.

Where is better to store?

The storage of stablecoins depends on the needs of the user. The most common options:

- Online wallets. Wallets like Trust Wallet and MetaMask allow you to store stablecoins directly on your device, making them convenient for everyday use.

- Cold wallets. For maximum protection, stablecoins can be stored in physical wallets such as Ledger, Trezor, etc., which protect your assets from hacker attacks.

- Decentralized platforms. Some users prefer to store USDT-type stablecoins on decentralized finance (DeFi) platforms, where they can earn interest on the account or use it for loans.

- Centralized exchanges. They offer convenience and quick access to assets, but require trust in the platform as exchanges control the private keys of your wallets. Verification requirements may also require proof of your identity.

The best solution is a combination of these methods: keep the main amount of assets in a cold or decentralized wallet for maximum security, and a small part in a centralized exchange for fast transfers and trading.

Prospects of stablecoins for the future

With the development of the cryptocurrency market, stablecoins such as USDT are becoming more and more popular due to the provision of stability and convenience for users. However, regulatory authorities in various countries are still studying possible risks and ways to integrate stablecoins into financial systems.

In the coming years, you can expect:

- Increasing the capitalization of stablecoins on the global financial markets.

- The emergence of new types of stablecoins backed by various assets.

- Strengthening regulations and legal restrictions that will improve the security of using stablecoins.

In the future, stablecoin technologies will improve, which will increase the efficiency of transactions and make them even more convenient for users.

In the modern cryptocurrency world, stablecoins have become an important tool for capital protection and convenient financial transactions. Thanks to Obmifay’s monitoring, users can quickly and profitably buy or sell their USDT and other stablecoins, guaranteeing the security of their transactions and access to the best rates. To take advantage of all the advantages of stablecoins, be sure to follow the best offers from reliable exchangers on Obmifay.

Support

Support