Stablecoins have been the focus of European regulators lately, as they act as a bridge between fiat money and digital assets. Recent developments in the European market have caused a wave of discussions: exchanges have begun to massively delist USDT, the most popular stablecoin today. The reason for this is the new regulations that came into force thanks to the MiCA (Markets in Crypto-Assets) law. Tether is being replaced by USDC, an alternative supported by stricter transparency standards. What is behind this transition, and what risks and opportunities does it pose for investors and traders?

Why is Tether’s market share declining?

Despite its huge capitalization and key status in the cryptocurrency sector, Tether (USDT) is increasingly facing questions regarding transparency, reserves, and regulatory compliance. Since 2022, there has been a gradual decline in the share of USDT on European exchanges, especially after the MiCA regulations came into force. One of the main problems remains the lack of sufficient support in the form of fiat reserves that fully correspond to the declared peg to the US dollar (USD). The issuer Tether Limited does not provide regulators with a full picture of the audit of its assets, which makes the coin less attractive to European platforms and institutional players. In addition, the market is becoming increasingly sensitive to financial control standards. Trading with an unstable or poorly regulated stablecoin is beginning to be perceived as a high-risk area. This leads to restrictions on USDT transactions, a decrease in transaction volumes, and a gradual abandonment of the coin in regions.

What is important to know about the regulation of Tether stablecoins in the European market?

MiCA, adopted by the European Union, has become a key law regulating crypto assets and, in particular, stablecoins. The document obliges issuers to provide support for stablecoins in fiat currency and disclose the composition of reserves, as well as undergo regular audits, obtaining an appropriate license to provide services on the European market. One of the central provisions of MiCA is compliance with the standards of transparency, financial stability and protection of user funds. It also introduces restrictions on the use of unlicensed stablecoins in trading, financing, settlements and digital transactions. Thus, the exchange providing access to stablecoins is obliged to ensure that the assets comply with the standards.

Let us emphasize: the goal is not to completely ban alternative currencies on the market, but to create a structured and stable market capable of interacting with financial institutions, central banks and customers on equal terms.

Why was the USDT stablecoin banned in Europe?

Formally, the USDT stablecoin was not banned at the legislative level. However, in fact, it was isolated: European exchanges began to restrict its listing and trading as part of the implementation of the MiCA law. The main reason is the non-compliance with regulatory requirements for transparency, issuer obligations and pegging to the USD.

In practice, this means that Tether USDT has not passed the necessary verification and has not received a license to provide services in Europe. The volume of Tether USDT began to decline sharply after exchanges began to massively withdraw the coin from pairs with the euro, and then with the dollar. In particular, large platforms began to refuse operations related to deposits, withdrawals, and trading with USDT in pairs with the European currency. In addition, EU central authorities and financial regulators draw attention to the risk of manipulation, the lack of open data on reserves, and the opaque governance structure of Tether. This makes Tether USDT too unpredictable and unreliable in the eyes of legislators and investors.

What is USDC stablecoin?

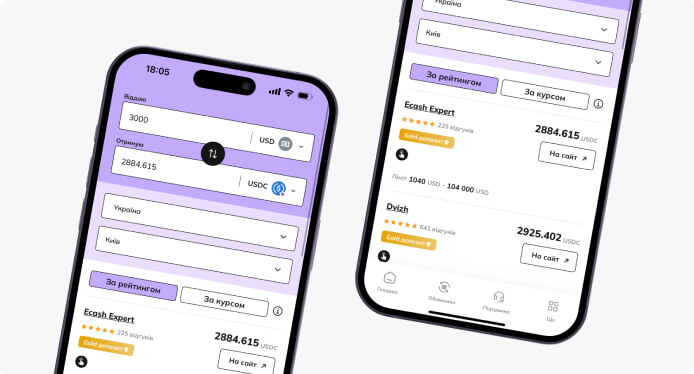

USDC is a stablecoin issued by the Centre consortium, which includes Circle and Coinbase. The coin is pegged to the US dollar (USD) and is backed by fiat reserves held in American bank accounts. The main difference of USDC is the maximum level of transparency: the issuer regularly publishes financial reports, undergoes audits and cooperates with financial regulators of the US and EU. In terms of regulatory compliance, USDC has become a key candidate for the role of the main stablecoin in Europe. Due to compliance with MiCA standards, exchanges are willing to integrate it into their trading pairs, including pairs with the euro, dollar, and other cryptocurrencies. USDC’s liquidity, accessibility, and stability make it attractive for both businesses and private traders.

Differences between USDT and USDC

The main difference is the level of trust. USDC offers a high degree of transparency, detailed audit of reserves, accountability to regulators, and full compliance with current financial standards. USDT, in turn, is known for its unstable support structure, limited disclosure, and lack of centralized supervision.

Why European exchanges choose USDC over USDT stablecoin?

European exchanges are betting on USDC because it allows them to operate within the MiCA regulations, avoid fines and ensure the security of transactions for their clients. Moreover, euro support, the issuer’s financial license and approval from regulators make USDC not only an alternative but also a preferred solution in the EU stablecoin market. The key advantage is the ability to work with banks, payment systems, as well as connect to projects related to digital euros, financing, decentralized platforms, trading platforms and international projects in the Web3 sphere.

What should an investor do in this case?

It is important for an investor to adapt to the new situation. If USDT was previously perceived as a standard, today it is becoming limited in use in the European space. Therefore, the transition from USDT to USDC looks like the most logical step to maintain liquidity, access to platforms and participate in trading. It is also important to monitor the actions of regulators, follow updates to laws and exchange policies, and be prepared for changes in the exchange rate, capitalization, and trading volume. In the future, we should expect the influence of central bank digital currencies to increase, which will also affect the stablecoin market. Strengthening control over crypto assets in Europe is not a ban, but a structuring. USDT has found itself outside the new standard, while USDC has adapted to the demands of the times. For those who want to maintain security, stability, and access to European crypto transactions, the choice is obvious.

Support

Support