Nowadays, cryptocurrency has gained considerable popularity, along with this the question arises how quickly and safely you can exchange cryptocurrency, or withdraw it to a bank account or card.

A reliable solution to this issue is a specially designed platform. A cryptocurrency platform offers fast and secure payment processing, a wide selection of cryptocurrencies, protection against fraudulent activities, and an interface accessible to everyone.

Currently, many different platforms with similar functionality have been created. However, each has its own advantages and disadvantages.

When choosing a currency withdrawal platform, attention should be paid to the following points:

- Security, which includes an officially registered legal entity (check on official websites). The selected platform’s website should have a published offer, privacy policy, and, of course, HTTPS security protocol.

- Be sure to check reviews. Checking reputation is one of the main rules for choosing a cryptocurrency exchange platform.

- Analyze the feedback channels, technical support, and whether the platform shows commission for currency withdrawal operations. Check how convenient it will be to use the chosen platform.

- Review the functionality of the cryptocurrency withdrawal platform. Which coins it supports, whether exchange can be done using a P2P service, etc.

Choosing the method of withdrawing your assets needs to be done carefully to avoid problems and not encounter fraudsters when withdrawing currency.

Cryptocurrency: withdrawal methods

To withdraw cryptocurrency, you can use the following methods:

- Cryptocurrency exchanger. This is an online service that exchanges cryptocurrency at the current rate, with express processing of the operation. It works on the P2P exchange method;

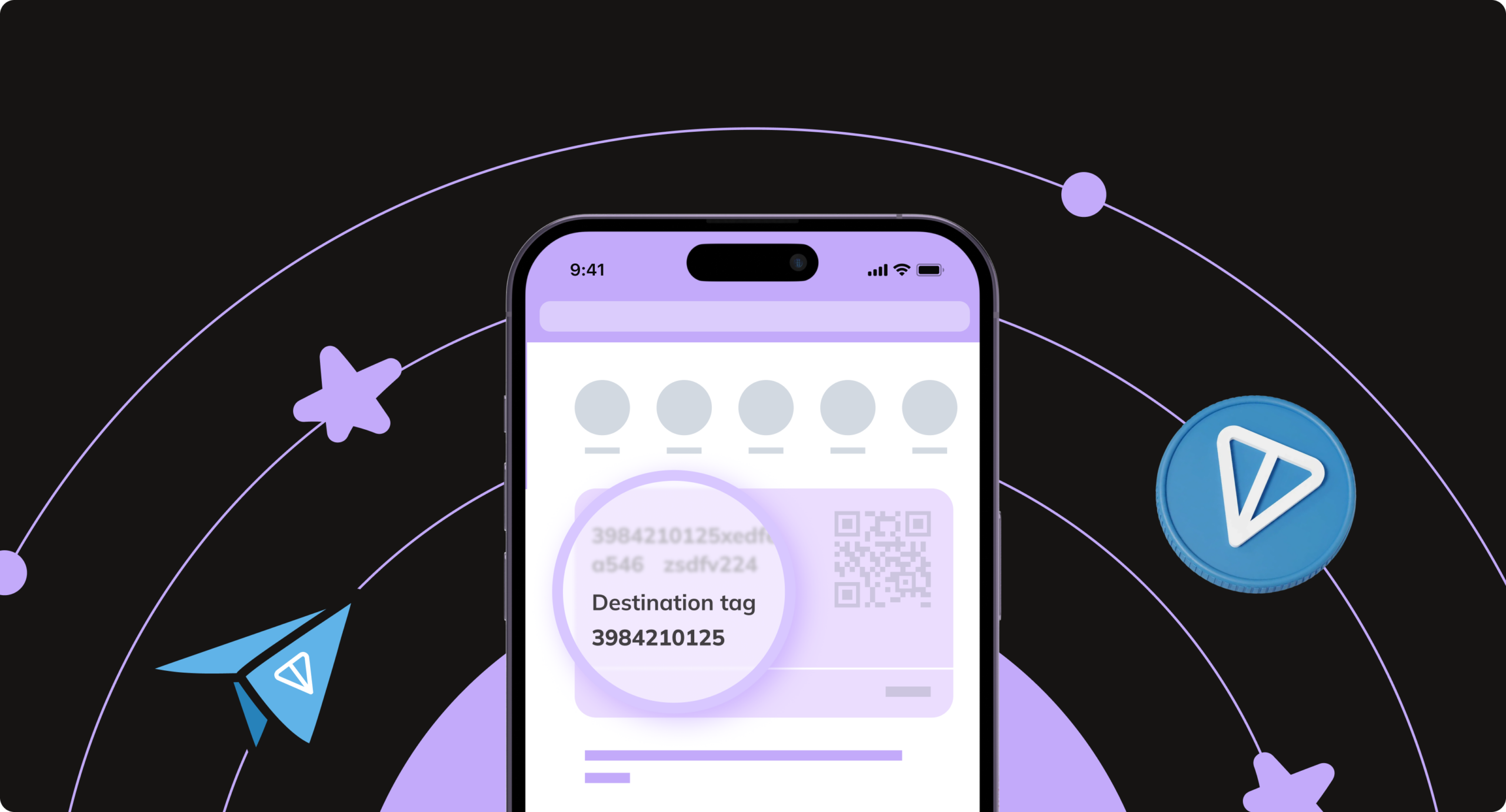

- Telegram bots that help convert and withdraw crypto within a few minutes. A Telegram wallet has been created, which stores transaction history, has technical support, and low fees. It provides the ability to set up auto-conversion at the rate at the time of funds being credited to the card;

- Crypto exchanges. Exchanges have a more extensive functionality than previous services. On the exchange, a user can exchange cryptocurrency for other cryptocurrencies as well as fiat money. Usually, exchanges charge their commission for withdrawing funds from their platform;

- P2P exchange occurs without intermediaries on special platforms. P2P exchanges offer favorable rates and lower fees. However, P2P operations may have a reduced level of security;

- Cryptomat. Similar to an ATM but for cryptocurrency. After exchanging for hryvnia, you can immediately receive cash. But you will have to wait for the operation to be executed. When choosing the processing time of the operation, consider the commission. The faster, the more expensive. Another drawback of cryptomats is that they are not widespread in Ukraine. And even in the capital, only a few are installed.

Most cryptocurrency withdrawal methods to a card support Visa and Mastercard systems. But it should be noted that some platforms cooperate only with one payment system.

How to use an electronic wallet to withdraw cryptocurrency?

To withdraw your assets from a cryptocurrency wallet, follow this algorithm:

- Log in to your cryptocurrency wallet account.

- Select the transfer/withdrawal function. This function may be named differently in different wallets.

- If your wallet allows withdrawing several types of cryptocurrencies, then choose the necessary one. If only one currency is available, then skip this step.

- Specify the desired amount of funds to withdraw. Check the withdrawal limit and commission in advance.

- Enter your personal card details. That is, the 16-digit number, card expiration date, CVV code (three digits indicated on the back of the card; if the card is virtual, the information is available in the personal account of the card-issuing bank).

- Confirm by checking the correctness of the entered data.

After verification, the funds are credited to the card. The currency withdrawal process can take from several minutes to several days. The time it takes for the funds to arrive depends on the wallet and the bank.

Limits and fees for withdrawing cryptocurrency to a bank card

Exchanges charge their percentages for withdrawing funds to a bank card. It can vary from 0% to 1.5%. It depends on the type of cryptocurrency and the chosen exchange. An additional exchange fee may be charged by the bank that issued the card to which the funds are withdrawn.

The withdrawal limit is set by the exchange’s management. However, to avoid blocking the transaction or the bank card on the exchange, the limit is set to a one-time amount not exceeding 20,000 hryvnias equivalent.

Is it possible to use cryptocurrency for payments in Ukraine?

Today in Ukraine, a service has been developed through which cryptocurrency has become a method of payment. It has become possible to pay for purchases online and offline using a POS terminal. Settlements are made via QR code, mobile application, or cryptocurrency wallet. Cryptoprocessing for crypto-to-crypto or crypto-to-fiat is used for this purpose.

Crypto-to-crypto is when the seller receives payment in cryptocurrency. If the currencies are different, then conversion into the seller’s currency occurs. It happens at the time of payment. This rule also applies to the crypto-to-fiat format.

In conclusion, cryptocurrency in Ukraine has gained such momentum that there is a choice to withdraw it to a card or to pay directly for goods or services with cryptocurrency.

Support

Support

Дякую, цікава та пізнивальна інформація! 🙂

Дякуємо за відгук 🙂