In today’s world, many people perceive cryptocurrency as a high-risk asset. Your cousin’s friend’s neighbor lost out after investing in Bitcoin in 2021, and now everyone around shudders at the mention of the word “cryptocurrency,” thinking it’s something related to scams, loss of money, pyramid schemes, and so on.

But this is a stereotype because:

a) Cryptocurrency isn’t just about trading (buying and selling to profit from price changes)

b) Crypto coins don’t necessarily have to be volatile, meaning they don’t rapidly change in value

There are cryptocurrency tools that offer (surprisingly) stability. One such tool is stablecoins. In this article, we will look at what these coins are, their advantages, how they can be used, and what Obmify has to do with it.

What are Stablecoins and Their Advantages

Stablecoins are cryptocurrency assets linked to real assets such as fiat currencies (dollars, euros, etc.), gold, or even other cryptocurrencies. However, the unique feature of stablecoins is that they have a stable value that doesn’t change much. This sets them apart from other cryptocurrencies that often experience significant fluctuations.

There are several types of stablecoins:

Backed by Fiat

These are backed by traditional paper currency. For example, USDT, USDC, BUSD are digital counterparts of the US dollar, and their value is pegged 1:1. EUROC, EURT, and EURS are tied to the Euro, XCHF to the Swiss Franc, and XSGD to the Singapore Dollar.

Backed by other crypto

For instance, stablecoin DAI – its nominal value is pegged to the dollar, but it’s actually backed by several cryptocurrency holdings (e.g., ETH, BAT, WBTC). This minimizes risk for token holders and enhances the stability of DAI.

Backed by Commodity Markets/Real Assets

For example, Digix Gold (DGX) is backed by gold, while Tiberius Coin (TCX) combines 7 precious metals. SwissRealCoin (SRC), on the other hand, is backed by a real estate portfolio in Switzerland. This means stablecoin holders possess something with real value that could potentially increase in the future.

The main advantage of stablecoins over other cryptocurrencies is providing stability and reliability in transactions. They help mitigate the risks associated with the volatility of cryptocurrency markets.

On the other hand, a clear advantage over banking alternatives is the decentralized nature of stablecoins. This ensures anonymity – no one can control your funds or track their movement as banks do globally. This makes them attractive for various use cases.

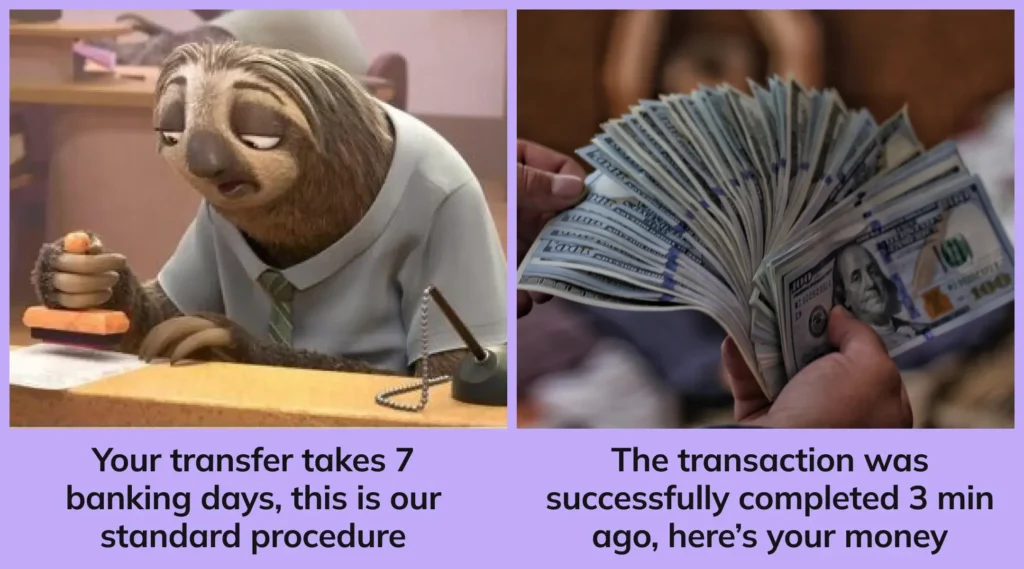

Moreover, a crypto transaction takes only a few minutes, and the blockchain doesn’t know about national holidays and non-working days 🙂

Methods of Using Stablecoins

There are so many of them that this section will have to be divided into several subsections and talk about each one in more detail.

Money Transfers

Thanks to the stability of stablecoins and the speed of transactions, they became an ideal means for international payments and transfers. Stablecoins allow for fast and efficient money transfers without the need to use complex international transfer systems. Let’s consider a few cases:

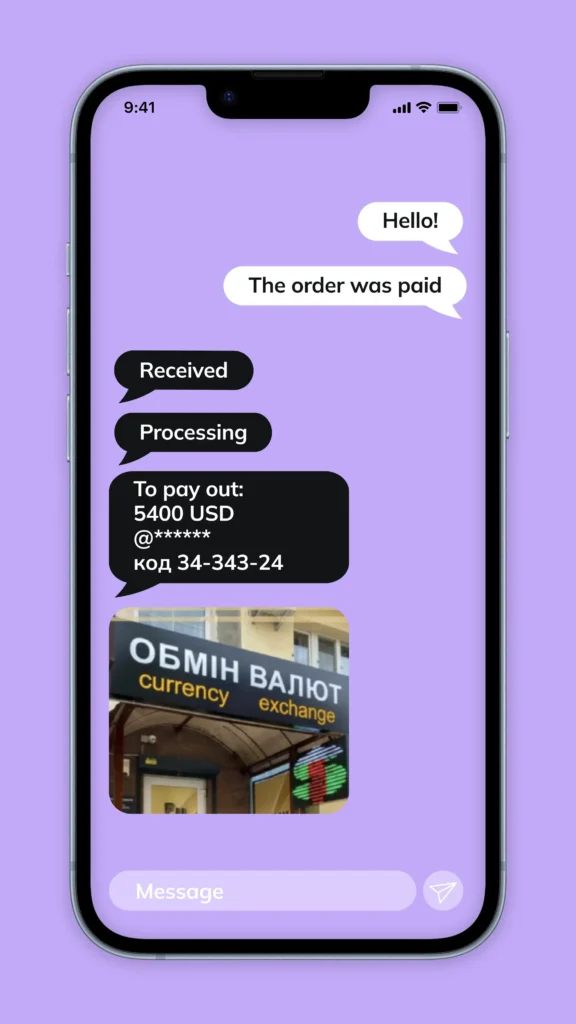

- Vasyl urgently needs to transfer a considerable amount in foreign currency to Mykola in Lviv for buying a car. Ukrainian banks do everything through hryvnia, which results in significant loss of money and additional inconveniences. Western Union charges high fees, and for a large amount, they might even ask for the source of funds, and Vasyl doesn’t have time for extra bureaucracy. Putting dollars into a crypto wallet and making a transaction to his friend takes 15 minutes without any questions from either the exchange in Kyiv or the cash desk in Lviv. Mykola doesn’t even need to have any documents, just the transaction code from the exchange. By the way, you can always perform such an exchange at the best rate on Obmify. Here, you can find the best rate for today, check exchanges by reviews, limits, and reserves.

2. Hanna is in Kharkiv, and her mother is in Germany. She hasn’t had time to open a bank account yet, but Hanna knows about stablecoins and can simply exchange USDT for cash in Berlin, and her mother doesn’t even need to know what this “crypto” is.

3. You are traveling to another country for an extended period and are afraid to carry a wad of cash with you. You can deposit money into your crypto wallet in stablecoins and withdraw them in the necessary cities as soon as needed. No customs problems, no nerves due to unreliable hotel doors, no fear in public transport. It’s just a digital dollar that’s always in your wallet, and you don’t need a card or documents to withdraw it.

Trading

Stablecoin is a reliable friend of a trader, as you can keep a portion of your funds in, for example, USDT and gradually buy coins when needed, instead of replenishing the balance on the exchange every time. The same goes for selling – to sell a coin and lock in profits, you don’t necessarily have to immediately withdraw the money to your card. You can exchange the coin for a stablecoin and keep it in case you need to buy some asset.

Cryptocurrency Deposits on Exchanges

Some exchanges offer advantageous staking conditions – it’s like a bank deposit, but instead of paper money, cryptocurrencies are used. The longer the term of the deposit, the more interest is accrued. And by the way, these percentages are much higher than the meager 0.1% annual interest rates in banks, which don’t even cover inflation. Here’s an example from WhiteBit exchange:

Payment for Services and Goods

Stablecoins can also be used for paying for various services and goods.

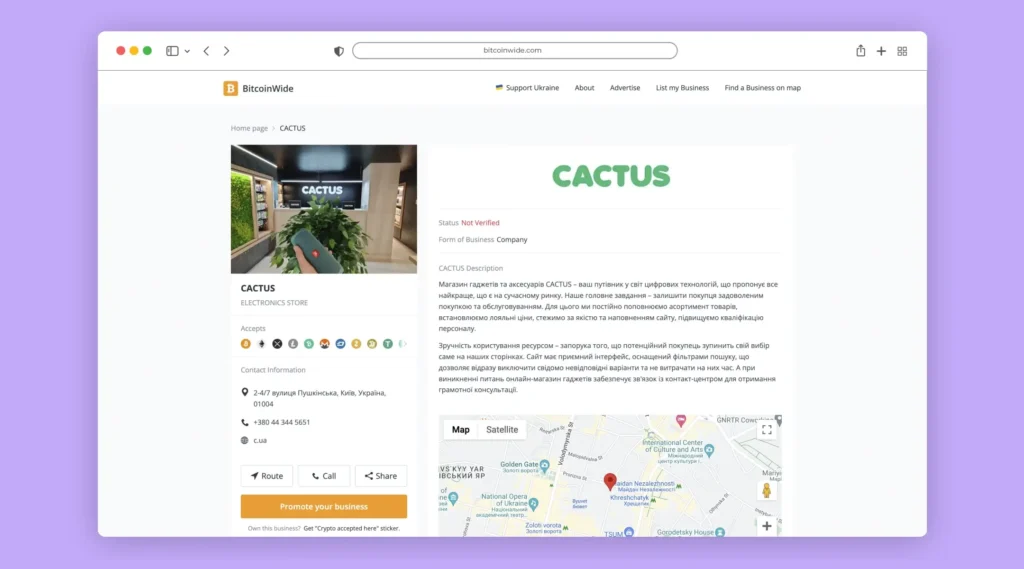

Many companies and businesses are starting to accept stablecoins as a form of payment, as they are reliable, fast, and have a stable value. There’s even a dedicated website where businesses that accept cryptocurrency payments are listed – BitcoinWide. Here, you can find the desired product or service categorized by cryptocurrency type or even on a map:

What’s Next?

Stablecoins are a reliable and secure way to use cryptocurrency. If you think of USDT as a digital dollar, you can understand that there’s nothing scary or “gray” about using it. Today, many IT professionals receive their salaries in stablecoins, and digital dollars are used to buy property in Portugal and yachts in Monaco. Stablecoins have become more than just a trendy coin; they are a real method of settlement in various industries and niches. And not to mention money transfers, trading, asset storage, and multiplication, etc.

We hope this article provided you with an understanding of stablecoins and how they can be used in everyday life. And if you need advice on how and where to buy Tether (USDT) with a Ukrainian card or how to convert crypto into cash, head over to the Obmify homepage. Here, you can compare today’s exchange rates across different services, check reviews for each service, and make informed decisions. Good luck!

Support

Support